Mortgage Blog

10 Easy Steps to Funding Your Mortgage and My Favourite Feel Good, Almost Impossible Mortgage Story

February 18, 2021 | Posted by: Debbie Belair

The beauty of using a Mortgage Agent or Broker, is we carry most of the burden of moving your mortgage file from one step to the next. That said, we recently had a client ask so many questions about each step of her mortgage that we were inspired to share the nitty gritty, all the details that took her mortgage from initial application, to finally funding a few months later. The beauty of the process with this specific client, is that she really got a transparent view of everything the brokerage, the lawyer and the lender does to bring her dream home into reality. If you’re a future home owner that wants to dive into understanding how your mortgage goes from an online application to funded fruition, read on!

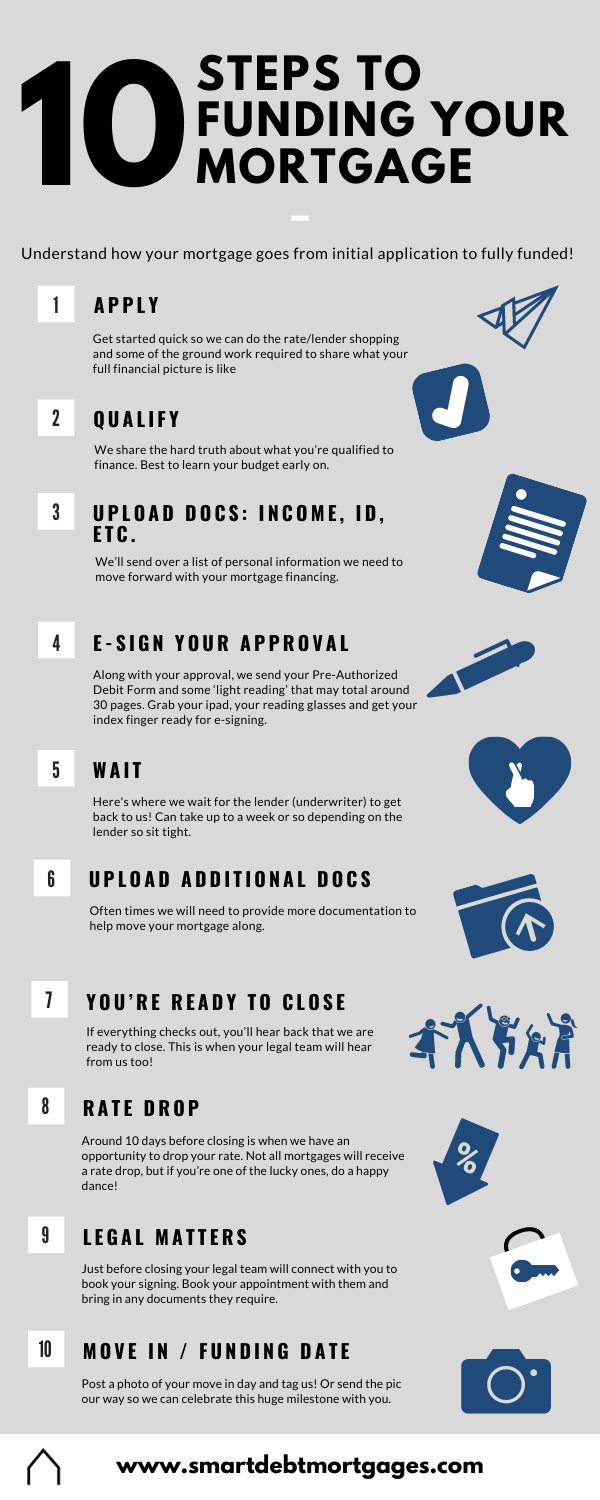

10 Steps to Funding Your Dream Home

- Apply – Get started quick so we can do the rate/lender shopping and some of the ground work required to learn your full financial picture.

- Qualify – We share the hard truth about what you’re qualified to finance. Best to learn your budget early on, before you go house shopping or get your hopes up.

- Upload Documents: Income, Down Payment, ID and more – Once you’ve found the property you want to buy and your offer has been accepted we’ll send over a list of personal information we need to move forward. Read each document request carefully to eliminate the back-and-fourth!

*We wait until you have a property in mind for this step because we don’t want your paperwork to be stale dated. Only recent documents are accepted.

- E-sign your approval - Along with your approval, we send your disclosure documents, amortization schedules, your Pre-Authorized Debit Form and some ‘light reading’ that may total around 30 pages. Grab your ipad, your reading glasses and get your index finger ready for e-signing.

- Wait – Each document from your file is being audited by us and then a final review with the lender's underwriter. This can take up to a week so sit tight to see if anything further is required!

- Upload Additional Supporting Documents – Sometimes we will need to provide more documentation to help your mortgage along. For example, we may need to show your continued income stream, proof a debt was paid etc.

- You’re ready to close – Once everything checks out, you’ll hear back that we are ready to close. This is when your lawyer will hear from us too!

- Rate Drop – Around 10 days before closing we will re-shop the mortgage market to ensure you still have the best offer based on your profile and drop your interest rate accordingly. Not all mortgages will receive a rate drop, but if you’re one of the lucky ones, do a happy dance!

- Legal Matters – About a week before closing your legal ream will connect with you to book your signing and inform you of the exact amount needed on your bank draft(s). They will also remind you that you need a home insurance policy to cover your lender for your new home. You’ll need 2 pieces of valid identification and one must be a picture ID. If you’re buying a new property, your lawyer will also arrange a place to get your keys on closing day!

- Move In / Funding Date– This is the most exciting step in the journey and where we wish you would remember to include us. One photo of your cutest pet on the front step or favourite artwork on the wall is all we ask! And a 5 star google review, if we’re being honest!

How is this different from a bank? So many reasons, but lower rates especially!

Many won’t have as competitive rates, typically speaking. Just as Insurance Brokers can shop around for the best insurance rates, mortgage brokers can shop around for the best mortgage rates. We have long standing relationships with up to 34 lenders and personal connections with underwriters. These relationships make a difference!

My Favourite Feel Good, Almost Impossible Mortgage Story

Meet my clients, they’re 80 years old. A couple whose incredibly talented daughter was opening a state of the art clinic to study and work with autistic children in a community that had a huge need for this and very little resources. My clients wanted to re-finance their house to help their baby, a PHD holder and entrepreneur. They came to me after they had already been declined by their bank. You see, most banks can’t justify the risk of lending to an 80 year old couple. I suppose I understand, because as we age, our health can decline and thus our ability to make payments. I was touched by their story and searched high and low for a lender who would be too. I found one and their daughter opened her center! It’s these stories that make all the details and 30 years of network-building worth it.

Here’s a quick infographic for our visual learners and feel free to click here to get started with your application!